Handling Market Volatility

Conventional wisdom says that what goes up must come down. But even if you view market volatility as a normal occurrence, it can be tough to handle when your money is at stake. Though there's no foolproof way to handle the ups and downs of the stock market, the following coping strategies may help.

Build an all-weather portfolio

Diversifying your investment portfolio is one of the key tools for managing market volatility. Different types of investments may perform differently in response to the same economic conditions. So when you divide your money among various asset classes and investment vehicles, gains in one area can help compensate for losses in another, which can help limit your risk of loss.

Whether you consider yourself to be a conservative or aggressive investor, an asset allocation strategy involves dividing your portfolio into different asset classes (such as stocks, bonds, and cash alternatives) to seek the highest potential return at the level of risk that you are comfortable with.

Determining the appropriate mix of investments based on your financial situation, appetite for risk, and time frame can be challenging, but an objective financial professional can help. In fact, a financial reality check might prepare you for the next time market conditions shift.

Of course, there is no assurance that working with a financial professional will improve investment performance.

Focus on the big picture

As the market goes up and down, it's easy to become fixated on day-to-day returns. Instead, keep your eyes on your long-term investing goals and your overall portfolio. If you still have years to invest, try not to overestimate the effect of short-term price fluctuations on your portfolio.

While making too much of short-term gains or losses is unwise, so is ignoring your investments altogether. You should check your portfolio at least once a year — more frequently if the market is particularly volatile or when there have been significant changes in your life. You may need to rebalance your portfolio to bring it back in line with your investment goals and risk tolerance. Rebalancing involves selling some investments in order to buy others, which may result in a tax liability if they are not held in a tax-deferred account.

Keep your emotions under control

When the market goes down and investment losses pile up, you may be tempted to pull out of the stock market altogether and look for less volatile investments. The modest returns that typically accompany low-risk investments may seem attractive when more risky investments are posting negative returns.

Before you leap into a different investment strategy, however, make sure you're doing it for the right reasons. How you choose to invest your money should be consistent with your goals and time horizon.

For instance, putting a larger percentage of your investment dollars into vehicles that offer asset preservation and liquidity (the opportunity to easily access your funds) may be the right strategy for you if your investment goals are short term and you'll need the money soon, or if you're nearing a long-term goal such as retirement. But if you still have years to invest, keep in mind that stocks have historically outperformed stable-value investments over time. If you move most or all of your investment dollars into conservative investments, you will not only lock in any losses you might have, but you will also sacrifice the potential for higher returns.

As the market recovers from a down cycle, elation quickly sets in. If the upswing lasts long enough, it's easy to believe that a popular investment is a sure thing, regardless of the risk. But, of course, it never is. As many investors have learned the hard way, becoming overly optimistic during the good times can be as detrimental as worrying too much during the bad times. The right approach during all kinds of markets is to be realistic. Have a plan, stick with it, and strike a comfortable balance between risk and return.

Put dollar-cost averaging to work

Like every cloud, a down market has a silver lining: the opportunity to buy shares of stock at lower prices.

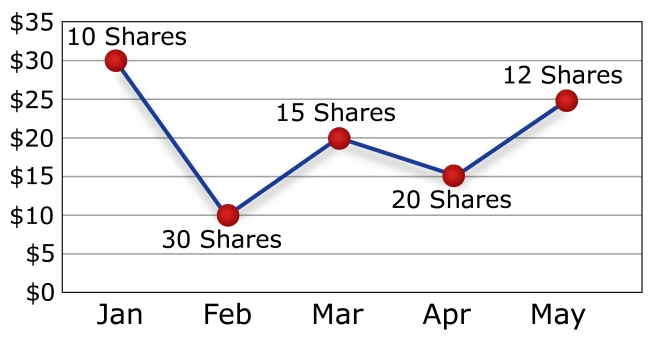

Dollar-cost averaging is a strategy that leverages this opportunity by investing a specific amount of money at regular intervals over time. When the price is higher, your investment dollars buy fewer shares of an investment, but when the price is lower, the same dollar amount will buy more shares. A workplace savings plan, such as a 401(k) plan in which the same amount is deducted from each paycheck and invested through the plan, is a common example of dollar-cost averaging in action.

For example, let's say that you decided to invest $300 each month. As the illustration shows, your regular monthly investment of $300 bought more shares when the price was low and fewer shares when the price was high:

(This hypothetical example is for illustrative purposes only and does not represent the performance of any particular investment. Actual results will vary.)

How can you make the most of this time-tested strategy?

- Get started as soon as possible. The longer you have to ride out the ups and downs of the market, the more opportunity you have to build a sizable investment account over time.

- Stick with it. Dollar-cost averaging is a long-term investment strategy. Make sure you have the financial resources and the discipline to invest continuously through all types of market conditions, regardless of price fluctuations.

- Take advantage of automatic deductions. Having your investment contributions deducted and invested automatically makes the process easy and convenient.

Although dollar-cost averaging can't guarantee a profit or avoid a loss, a regular fixed-dollar investment may result in a lower average price per share over time, assuming you continue to invest through all types of market conditions.