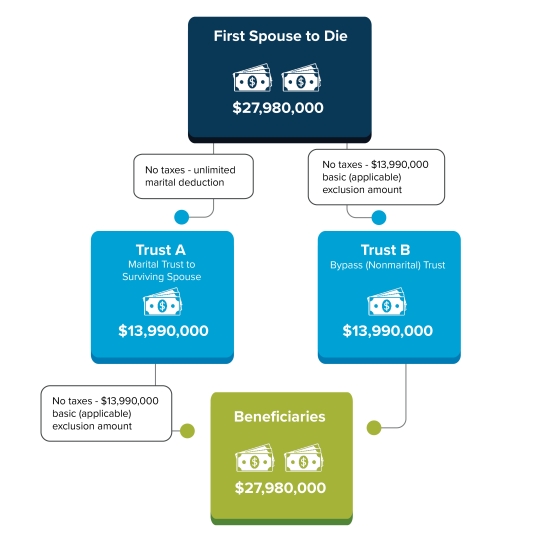

A/B Trust Diagram: $27,980,000 Estate

|

The Tax Cuts and Jobs Act, signed into law in December 2017, doubled the gift and estate tax basic exclusion amount to $11,180,000 in 2018. It is $13,990,000 in 2025 ($13,610,000 in 2024). After 2025, the exclusion is scheduled to revert to its pre-2018 level and be cut by about one-half.

Prior to 2011, each taxpayer was entitled to use only the exclusion allotted to him or her, and any unused exclusion amount would be lost. A married couple could ensure they

fully used their respective exclusion amounts by implementing an estate plan that split a spouse's estate into a marital portion (Trust A) and credit shelter portion (Trust B), as illustrated.

In 2011 and later years, portability of the applicable exclusion amount between spouses may reduce the need for A/B trust planning, because it allows the executor of the first deceased spouse's estate to transfer any unused exclusion amount to the surviving spouse (along with the surviving spouse's own exclusion). This "portability" allows the second spouse to die to dispose of $27,980,000 (in 2025, $27,220,000 in 2024) worth of assets, estate tax free, without the need of planning. However, even with portability, there may be other tax and nontax reasons to implement an A/B trust, including:

- Sheltering the difference between the inflation and appreciation from estate tax

- Spendthrift and creditor protection

- Ability of the first spouse to die to control assets after death