By Greg Ip

July 14, 2023

Americans’ two biggest economic worries are recession and inflation. The two are connected: the more stubborn inflation remains, the more likely it will take a recession to get it down.

Joe Raedle/Getty Images

The latest data suggest the risk is diminishing. Headline inflation has slid from 9.1% in June last year to 4% in May and 3% in June of this year. Much of the latest month’s drop was technical: a surge in prices in June 2022 finally dropped out of the 12-month calculation. Because that won’t be repeated, headline inflation could rise in coming months.

More encouraging is that underlying inflation has edged lower in recent months, even though the labor market has yet to weaken significantly. This suggests the odds of a soft landing, in which inflation returns close to the Fed’s 2% target without a recession, are improving.

Two forces have been at work since inflation bubbled up in 2021. The first is transitory shocks to supply chains, energy, real estate and the labor force brought on by the pandemic, stimulus and war. The second is the underlying forces of supply, demand and expectations. Only once the transitory effects recede will we know where those underlying forces have left inflation.

It took longer than expected, but those transitory forces have mostly subsided now. Gasoline prices are roughly back to where they were before Russia invaded Ukraine. Airfares shot up 20% between the start of the pandemic and June 2022; they’ve fallen 19% since, including 8% last month. Between the start of the pandemic and January 2022, used car prices shot up 55%. They’ve fallen 8% since, including 0.5% last month. Auction data suggest further declines are in store.

The cost of housing, one of the biggest components of the consumer-price index, soared during the pandemic thanks to low mortgage rates, pandemic-driven migration, and construction material shortages. But private measures of rent increases have slowed dramatically in the last year, and that, too, should nudge official inflation rates lower in coming months.

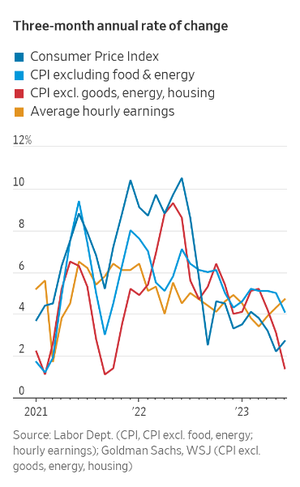

So where does that leave underlying inflation? For that, economists turn to indexes that strip out the components most subject to unusual shocks. Excluding food and energy, the core CPI was up 4.8% in June compared with 6.6% nine months earlier. Excluding all goods, energy and housing, the CPI was up just 4% in the last 12 months, and a mere 1.4% at annual rate in the last three months.

Harvard University economist Jason Furman looks at seven different underlying inflation indexes over three-, six- and 12-month periods, then adjusts them to mimic the price index of personal-consumption expenditures, the basis for the Fed’s 2% target. The median of all those measures had fallen to 2.8% in June from 4% in April.

“I’m nervous about the euphoria” around the June CPI, Furman said. That said, he was “pleasantly surprised” at the progress on underlying inflation. He thinks that without a rise in unemployment, inflation will end the year around 3.5%; he expected 4% several months ago. He thinks that is still too high for the Fed: “A full-on soft landing would still require a decent amount of luck.”

But perhaps not as much luck as before. The high inflation rate had exaggerated the imbalance between supply and demand and thus the need for a recession to restore balance, said Goldman Sachs chief economist Jan Hatzius. “But if you are only modestly away (from balance), you can realistically rectify the situation through a period of below-trend growth. That is what we’ve been doing.”

While unemployment remains low at 3.6%, vacancies and voluntary quits have steadily dropped, according to government and private data. That is a sign that, between slowing sales and robust hiring, businesses are no longer desperately short of workers. Another good sign: consumers’ expectations of inflation in the coming year have dropped a lot. High inflation expectations can be self-fulfilling.

None of this means the inflation battle has been won. Even though the Fed has raised interest rates 5 percentage points since early 2022, the impact seems to have faded. The stock market isn’t far from a record high, and housing activity has rebounded. Wages are still growing at 4% to 5% a year, a percentage point faster than is consistent with 2% inflation.

And one clear lesson of the economic roller coaster of the last three years is be careful about extrapolating a few pieces of data. Euphoria one month can easily turn to despair the next.

Write to Greg Ip at greg.ip@wsj.com

Dow Jones & Company, Inc.