By Cheryl Winokur Munk

Nov. 8, 2023

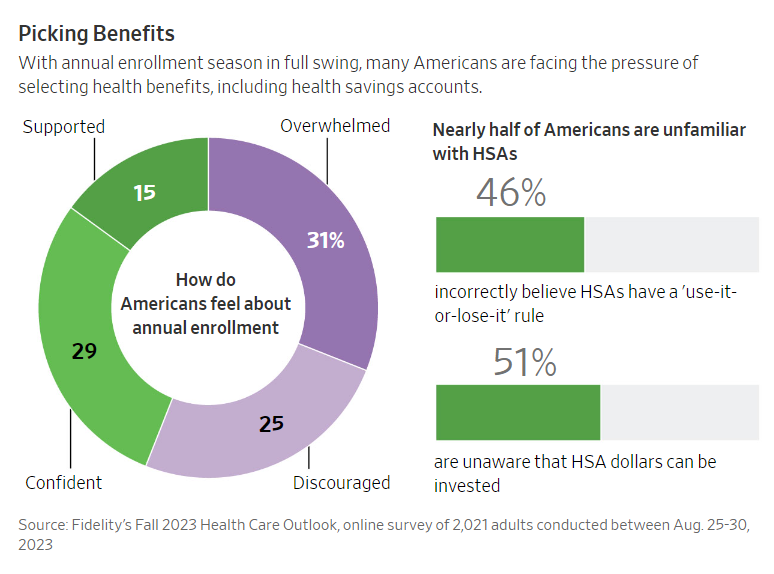

Health-savings accounts, and the triple tax benefits they can bestow, aren’t necessarily a secret anymore. But these accounts remain an enigma for many Americans.

Not everyone has the option to participate in an HSA, but even if they do, many don’t use it fully. This is underscored by data showing that about 73% of employees with an HSA contributed to their account in 2021, according to the Plan Sponsor Council of America, a nonprofit trade association for employers.

iStock image

Yet that still leaves many eligible workers who haven’t opened an account or, if they have, they haven’t contributed or invested the money for growth. These are missed opportunities, financial advisers say, given that deposits are tax-deductible, growth is tax-free and withdrawals are, too, as long as the money is used to pay qualified medical expenses.

With open-enrollment season for healthcare insurance in full swing, and 2024 contribution limits for HSAs increasing by several hundred dollars—to $4,150 for self-only coverage and $8,300 for family coverage—now could be a time to consider the benefits of opening or optimizing an HSA.

Many people don’t understand all of the benefits an HSA can offer, in part because they confuse them with flexible-spending accounts—which allow you to set aside pretax dollars to pay for some out-of-pocket healthcare expenses for a given year. They think the money in an HSA has to be used in a given year, or soon after. It doesn’t. They don’t realize that if they start an HSA early in their working life, fund it consistently and invest the money well, it can help them when medical bills arrive in retirement.

And it can produce tax-free income, in the form of reimbursements to themselves for bills paid years earlier, if they kept the receipts, and the medical expenses were incurred after the start date of the HSA.

“Put the money inside the HSA and let it actually grow,” says Brian Copeland, director of financial planning with Hightower Wealth Advisors in St. Louis. “Don’t just think of it like a flexible-spending account. It is way better.”

Here are answers to frequently asked questions about HSAs:

Who can use an HSA?

To contribute to an HSA, your employer must offer a high-deductible health plan, and many do. This type of plan generally means lower premiums, but you’ll pay more out of pocket for care before insurance kicks in. More than half of U.S. private-sector workers, or 55.7%, were enrolled in high-deductible health plans in 2021, according to a study by LendingTree’s ValuePenguin unit.

Before opting for a high-deductible plan, it is important to factor in a few things to make sure it is to your advantage. First, consider your health, your family needs and how often you or your family seek medical treatments. Also look at what you are currently paying in premiums, your current deductible, how other available plans compare and your maximum out-of-pocket cost on the new plan.

Don’t choose such a plan thinking you are at low risk of incurring a surprise, high-cost medical bill. You might be. But if something happens and you can’t afford to pay your deductible upfront or soon after, you should probably forgo a high-deductible plan.

It is also important to consider whether your doctors are covered by the plan. Out-of-network providers may cost even more, which can negate the premium savings associated with a high-deductible plan. This could be an even bigger consideration for people who travel frequently and may have to rely more heavily on out-of-network providers, Copeland says.

Why consider an HSA?

Assuming a high-deductible plan fits your needs, contributing to an HSA has advantages in addition to the triple tax benefits. Namely, the potential for your money to grow significantly over time, and the possibility of tax-free withdrawals without restrictions on how the money is spent.

Copeland explains how that would work. For example, he says, if you have a $10,000 medical bill that you can afford to pay out of pocket, do so and leave the money that’s in the HSA untouched. Give it time to grow. Since there is no deadline for taking reimbursements, you can wait as long as you want to, Copeland says. If you wait until you’re retired, provided you’ve saved your receipts, you can withdraw $10,000 from the HSA tax-free as a reimbursement to yourself. And you’ll have no restrictions on how you spend that money. Just remember to have those receipts in case of an IRS audit.

Be sure to fill out and attach IRS Form 8889 to your tax return for any year in which there is activity in your HSA, including distributions or a contribution. This is true, even if the only activity is contributions made by your employer. Also know that if you take a distribution, your HSA provider will send you Form 1099-SA. Make sure everything matches before filing your taxes. More information on HSAs can be found in Publication 969, which is available on the IRS’s website.

Once you’re retired, using an HSA instead of your 401(k) to pay for medical expenses also has serious tax advantages. Consider that the average couple will face $377,000 in out-of-pocket medical expenses in retirement, according to data from NFP, a New York-based benefits consulting firm. If this couple only had their pretax 401(k) dollars available to fund this liability, they would need about $502,000 in gross distributions from their 401(k) account because of the taxes they would have to pay on withdrawals. If they used their HSA funds, however, they wouldn’t pay taxes on the withdrawals.

In addition, some companies put money into HSAs on an employee’s behalf—similar to a 401(k)-matching contribution—so that could be another reason to take advantage.

What can HSA funds be used for?

HSA funds can be used for many types of medical expenses, including deductibles, copayments and coinsurance. You might also be able to use the money for part of the cost of premiums for an eligible long-term-care-insurance policy, says Shellie Peters, principal and senior wealth adviser in the Bethesda, Md., office of the Colony Group.

Advertisement - Scroll to Continue

Why should I invest the money?

Most people who elect to contribute to an HSA aren’t taking full advantage of the associated financial-planning benefits. They might not fund the HSA or they leave funds sitting in cash, says Jared Benson, a retirement plan adviser at NFP. In 2021, 12% of accounts were investing, up from 2% in 2011, according to the Employee Benefit Research Institute.

While HSA money ideally should be allowed to accumulate and increase through investing, there are people who choose a high-deductible plan because it has a cheaper premium. An HSA can work for them, too, Benson says. Say, for example, they are able to free up $100 per paycheck by switching to a high-deductible plan. Instead of spending that savings elsewhere, he recommends they invest the money in an HSA, reap the tax benefits, and use it as medical expenses come up or down the road for retirement if they are able.

How often should I rejigger my investments in an HSA?

HSAs are similar to 401(k)s in that owners should reassess their investment options at least once a year, Peters says. The investments should be adjusted to fall in line with overall target allocations and risk tolerance.

It is also important for account owners to pay attention to rules regarding HSA contributions in the year they enroll for Medicare, Peters says. Those who enroll in Medicare can no longer contribute to their HSA. The rules related to HSA contributions and Medicare enrollment timing can be complicated, so speak with a tax professional.

Additionally, they shouldn’t withdraw money for expenses they have taken a tax deduction for. “You can’t double-dip,” she says. So, people who take an itemized deduction for a medical expense shouldn’t use HSA money for that particular expense, now or later on.

What should I do if my company doesn’t allow me to invest my HSA money?

Some 61% of companies responding to the most recent HSA survey by the Plan Sponsor Council of America offer investment options beyond a cash equivalent for HSA contributions. And using an employer-offered HSA is generally recommended because it allows for seamless pretax contribution and potential employer contributions, Copeland says.

But for those who work at companies that don’t allow HSA money to be invested, there are a number of banks and brokerage firms that offer HSAs with investment options. These third-party offerings are broadly available to people who participate in a high-deductible workplace medical plan, but they should be sure to consider factors such as investment options, interest rates, fees and minimum balances to open. You can then declare contributions at tax time to reduce your taxable income.

Can I contribute to a 401(k) and an HSA?

Absolutely. Andrew Mescon, chief executive of Charleston, S.C.-based Ballast Rock Private Wealth, generally advises clients who are saving for retirement to contribute at least the minimum amount in a 401(k) to get the full employer match, if offered, before turning to HSA accounts. “You are getting free money from your employer by doing that,” he says. Then, if you are still able to put money aside on a tax-advantaged basis, an HSA can be considered along with your other options.

Benson says he sees many people contribute aggressively to their 401(k)—above the employer match—but they might be better off putting that excess money in an HSA instead. He suggests they contribute to their 401(k) up to the employer’s match and then contribute to the HSA because of the likelihood of needing the money for medical expenses in retirement. After maxing out the HSA, they can fund the 401(k) further, up to applicable limits, if they have the means, he says.

Are there potential penalties to consider?

Before age 65, people who use HSA money for nonqualified expenses are subject to a steep withdrawal penalty from the Internal Revenue Service—20% on the amount withdrawn. In real numbers, if you spend $500 on nonqualified expenses, that amounts to a $100 penalty. After 65, or upon becoming disabled, this penalty doesn’t apply. Additionally, the IRS considers HSA funds spent on nonqualified expenses as taxable income.

“If the primary goal is saving for retirement, you really should only be using the HSA after you’ve maxed out your other options,” Mescon says. “Since it’s designed as a healthcare-related savings tool, its optimal benefits are realized when used specifically for that purpose.”

Dow Jones & Company, Inc.