By Charlie Wells

Oct. 5, 2023

The superlatives coming out of the bond market have been enough to get the attention even of investors who typically ignore the fixed-income side of their portfolios.

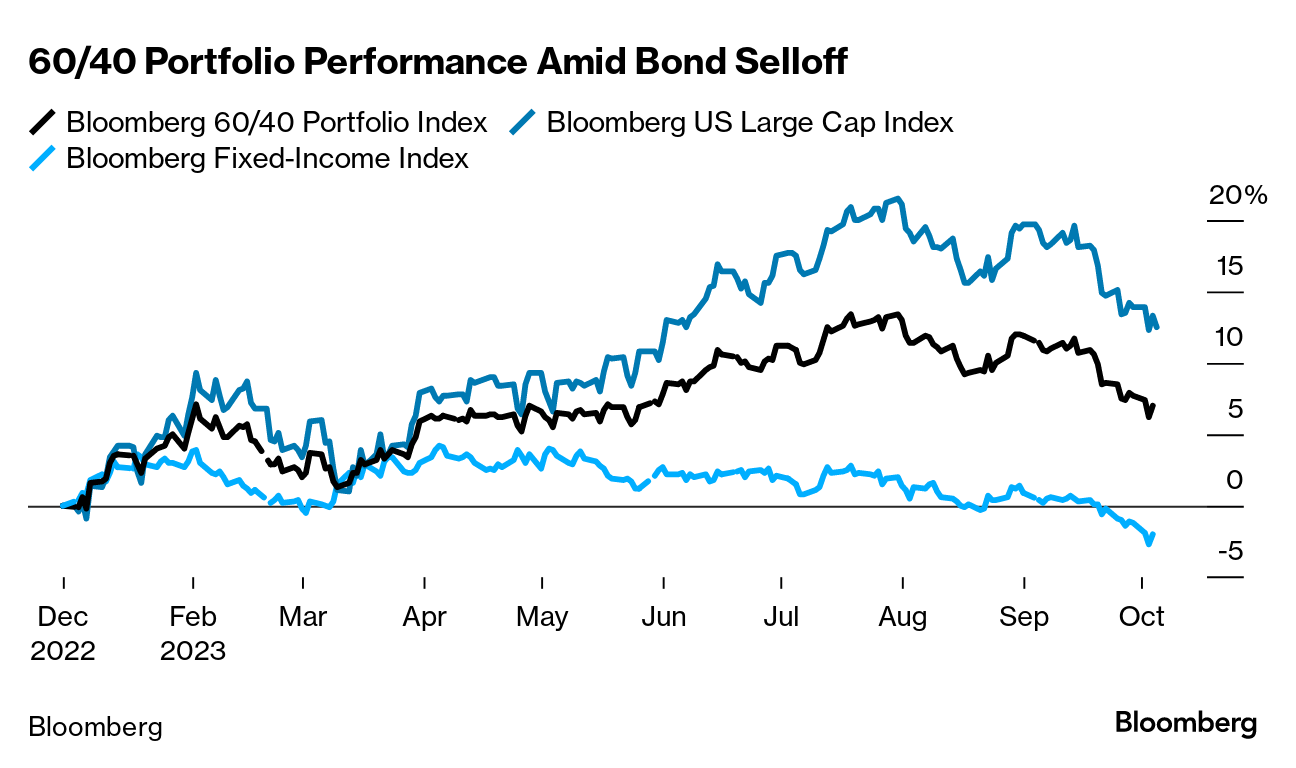

Yields on 10- and 30-year US Treasury bonds hit their highest point since 2007. It was a threshold crossing that left many wondering if they have the right asset allocation, especially if those moves are an indicator a recession is coming. The 60/40 equities-to-bond ratio has gotten heat in recent years, with advisers cautioning against a one-size-fits-all approach to investing.

Visitors outside the US Treasury building in Washington, DC.Photographer: Nathan Howard/Bloomberg

For decades, a 60/40 portfolio produced some of the best risk-adjusted returns on the market. But more recently, it’s been underperforming, and fixed-income’s wild week has reignited some concerns. Portfolios that held 60% stocks and 40% bonds actually fell 17% last year, their worst performance since 2008. (Stocks had a bad year too, with the S&P 500 down 19%.)

Yet financial advisers and investment experts Bloomberg News spoke to this week stressed the importance of maintaining discipline in the midst of all this noise. Some even cast this week’s events as a positive news story for investors, at least those focused on the long term.

“As the Federal Reserve is doing its work to combat inflation by raising interest rates, you’re going to see volatility in the bond market,” said Todd Schlanger, a senior investment strategist at Vanguard. “For an investor, it’s important not to overreact and to realize that these higher interest rates should translate into higher nominal returns for you in the long run.”

That is because although higher interest rates mean the current prices of bonds are falling, new bonds are also being issued with higher yields, providing long-term investors with an opportunity to pick up greater returns over time.

Another concern about the 60/40 portfolio has been that one of its fundamental traits was turned on its head last year. In an ideal world, bonds and stocks should have a negative correlation. Last year, they both declined. Yet Schlanger said getting hung up on that single year’s performance ignores the fundamental differences between stocks and bonds.

“We also need to remember that equities can decline by 50% or more,” he said. “Bonds are an inherently less risky asset class than equities even in today’s environment.”

Most advisers also noted that the term “60/40” shouldn’t be taken literally. It’s more a guidepost for investors to ensure they have diversification between stocks and bonds, and the precise asset allocation may need to change over time.

As Jonathan Shenkman of Shenkman Wealth Management noted: “There is no reason to do anything drastic” for investors who find the 60/40 split doesn’t work for their current circumstances. It comes down to risk tolerance and time horizon. A hypothetical 50 year old with a moderate risk tolerance may find 60/40 prudent if they’ll need the funds within 10 years. The composition may need to be different for a hypothetical 30 year old.

“If they realize that the 60/40 was the wrong approach for them, then simply rebalance their portfolio to a more aggressive strategy and consider saving more money every year to make up for the slight misstep,” Shenkman said.

Meanwhile, Laura Mattia, chief executive of Atlas Fiduciary, thinks the 60/40 rule could use something of an update. But she doesn’t want clients selling in a down market. Rather, she sees adding assets such as non-US equities, real estate, natural resources, convertible bonds and private equity to their portfolios as a way to add diversification beyond bonds.

“The primary aim is risk mitigation without compromising desired returns,” she said.

The key theme from all the experts I asked was that while this week might be a reminder about the importance of bonds to your portfolio — and a moment to reassess your precise allocation — now is not the time for any sudden moves.

© 2025 Bloomberg L.P.