By Glenn Ruffenach

March 27, 2019

I plan to retire in 2020. Any advice for a person a year or two out from retirement? What steps or tasks are more important than others?

If at all possible, you should put your retirement plans through a test-drive.

Granted, this might sound strange. Most people, seemingly, don’t need to “practice” retiring. (After all, what’s so difficult about not working?) In truth, though, retirement probably will come as a shock to your wallet and lifestyle, and if you can test your planned budget and daily routines before walking away from the office, the transition should be easier.

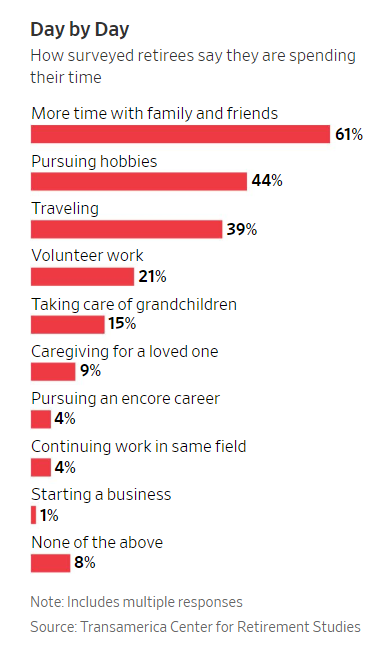

Start with your time—what you think a typical week might look like. Fill in your calendar with as many specifics as possible. Perhaps Mondays and Wednesdays are set aside for volunteer work. And Tuesdays for pickleball. And Thursdays for continuing-education classes. Write it all down.

Next (and I realize this can be tricky for some) take a sabbatical (or, if you prefer, a “staycation”). Block out at least two (or, ideally, three) weeks of vacation—but spend the time at home, following the calendar you set up. (And, as one financial planner told us, if your boss can’t spare you for three weeks or so—then ask for a raise.)

The first goal here is to find out if you’re really meant to retire. Are you bored after just two weeks of a trial run? Or does something on your experimental calendar need to be tweaked? As we have discussed in earlier columns, many people focus solely on their finances when it comes to retirement. But trying to figure out what an average week might involve is equally important.

Speaking of money, I will assume—if you’re a year or so from retiring—that you already have a budget on paper. Try living on your retirement budget for, say, four to six months. If your plan, for instance, calls for a monthly income in later life that amounts to 80% of your current income, then limit your monthly spending to the smaller figure.

If you find yourself going through your money at a faster rate than you anticipated, you need to revisit your retirement budget. Remember: Many retirees have told us through the years that their expenses don’t go down in retirement. Rather, they are simply replaced by new ones: travel, helping family members, entertainment, etc.

The larger point here: Retirement has enough unknowns as it is. The more you can experience before you cross the starting line, the better

***

If you plan to continue working through your mid-60s and beyond to beef up your nest egg, spend some time with two recent, sobering reports. Continuing to work beyond what might be considered a normal retirement age can help your finances, as well as your health. But keep in mind that planning to work isn’t necessarily a guarantee of work.

That point is made painfully clear in two recent studies: “How Secure Is Employment at Older Ages?” from the Urban Institute and “A Precarious Existence: How Today’s Retirees Are Financially Faring in Retirement” from the Transamerica Center for Retirement Studies.

The former found that almost half of full-time workers ages 51 to 54 “experience an employer-related involuntary job separation after age 50 that substantially reduces earnings for years or leads to long-term unemployment.” The latter found that more than half of retirees (56%) retired sooner than they had planned because of layoffs, ill health and family responsibilities, among other reasons.

The point: Yes, working longer can be a smart strategy to bridge gaps in retirement savings. But it shouldn’t be the only one.

Mr. Ruffenach is a former reporter and editor for The Wall Street Journal. His column examines financial issues for those thinking about, planning and living their retirement. Send questions and comments to askencore@wsj.com.

Copyright 2019 Dow Jones & Company, Inc. All Rights Reserved.