By Laura Davison and David Ingold

Aug. 22, 2022

The $80 billion injection of new money for the Internal Revenue Service to help it go after tax cheats amounts to more of a lifeline for an agency eviscerated by Republican-led funding cuts over many years, with challenges ahead in recruiting the talent it will need.

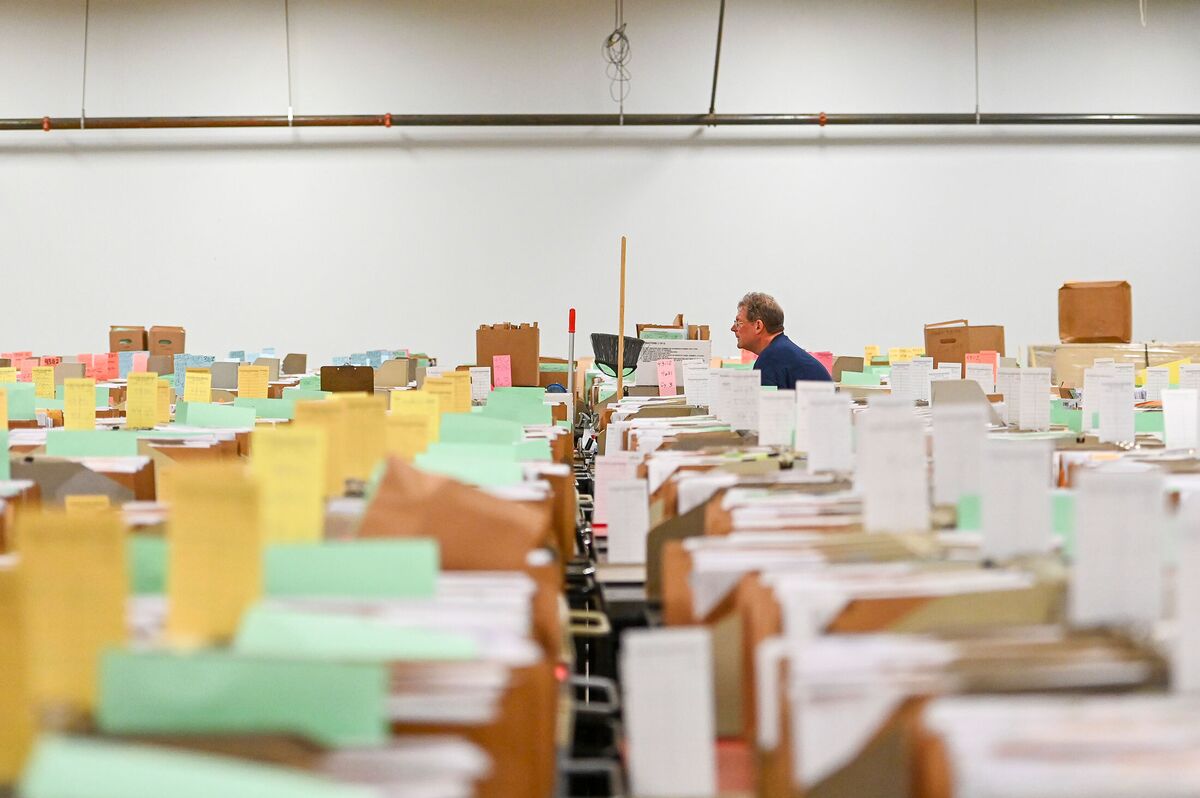

Tax documents at an Internal Revenue Service facility in Ogden, Utah, this year.Photographer: Alex Goodlett/The Washington Post/Getty Images

The IRS has lost more than 23,000 workers since 2010, and it’s projected to lose another 50,000 in the next five years to retirements alone; the agency had 80,000 at the height of tax season this year. Many of the losses in the past decade-plus have come from key departments that help enforce tax laws and assist taxpayers in fulfilling their duties.

Although the Inflation Reduction Act signed by President Joe Biden on Aug. 16 counts on increased revenue from IRS enforcement to help pay for a slew of climate-change initiatives, it could take years until the government starts seeing results as the agency rebuilds itself.

“Given the scope of the bill, keep in mind these changes will not be immediate,” IRS Commissioner Chuck Rettig wrote in a memo on Aug. 16 to IRS employees. “It’s a 10-year plan, and it will take time to put these provisions into place.”

IRS funding—or the lack thereof—has been one of the most under-the-radar political fights in Washington over the past decade. Republicans first went after the agency in 2010 over opposition to Obamacare, which was largely administered through the IRS.

In 2013, after a scandal involving an IRS official targeting conservative groups applying for nonprofit status, Republicans saw a major opening to go after the agency. They attempted—but failed—to impeach former IRS Commissioner John Koskinen in the years following the incident. The GOP was successful, however, in enforcing waves of budget cuts over a period of years, using their control of both the House and Senate.

The cuts forced the IRS to slowly pare back on audits of the wealthy. But the effects proved universal: Some refunds took years to process, and in time only 11% of calls placed to the IRS would reach a human customer service representative. Even as it struggled to keep up, the agency was assigned fresh tasks, including implementing the 2017 Republican tax law and distributing three rounds of stimulus payments during the pandemic.

The volume of complaints about low levels of service reached a fever pitch in 2020, forcing lawmakers to reckon with rebuilding the diminished agency. Some Republicans came to agree with Democrats on the principle that the IRS needed more money. Still, the new investment of $80 billion over a decade has not won universal support.

Republicans, including Chuck Grassley, a senior senator who previously chaired the Finance Committee, have said the funding will give the IRS the ability to hire an additional 87,000 armed auditors who will target middle-class taxpayers. Such messages seem to be sinking in: Some polls show that enhanced IRS enforcement is one of the least popular portions of the Inflation Reduction Act.

Senator Rick Scott, the Florida Republican who chairs the Senate GOP’s reelection arm, penned an open letter to the “American Job Seeker” warning them not to apply for open IRS positions and saying Republicans would claw back the funding that Democrats approved for the IRS. It’s unclear if or when Republicans could do that, though, as such a move would likely require the party to have majorities in both chambers of Congress and a president in the White House.

Still, Mark Everson, who served as IRS commissioner under President George W. Bush, says some Americans view the IRS with skepticism or even open hostility, which can make it difficult to recruit. He says that perspective is wholly misguided, because the agency is staffed by civil servants who perform tasks essential to running the federal government.

Connect the dots on the biggest economic issues.Dive into the risks driving markets, spending and saving with The Everything Risk by Ed Harrison.Sign up to this newsletter

The IRS hasn’t yet said how many positions it plans to add, but indications are expected in the coming months. Representative Bill Pascrell, a senior Democrat on the House Ways and Means Committee, has asked for details by the end of August about how the IRS plans to spend the money. More broadly, Treasury Secretary Janet Yellen has directed the agency to come up with a strategic plan by mid-February.

Even after the IRS gets new employees in the door, it takes time to get them trained to handle the complicated tax returns of high earners that Yellen says will be the focus of new audit teams. The IRS’s output may even diminish in the next few years as the agency taps its best employees to train newcomers, says Everson, now the vice chairman of tax advisory firm Alliantgroup.

“In the areas that receive the most emphasis—the complex returns, international businesses, multitiered partnerships, all those areas—you don’t just hand those to some brand-new auditor with his or her shiny new accounting degree,” Everson says.

The IRS and Democrats have moved to reassure Americans that the additional audit activity will affect only those making $400,000 or more and that additional staff includes a range of positions—not just enforcement officials. They’ve also advised that they won’t carry weapons.

“It’s unbelievable that we even need to say this, but there are not going to be 87,000 armed IRS agents going door to door with assault weapons. This is funding for answering phone calls and upgrading computer systems,” Senate Finance Committee Chairman Ron Wyden (D-Ore.) said in a statement this month.

Even so, an increase in scrutiny will be a rude awakening for some taxpayers. Audits on the highest-earning Americans—those reporting $5 million or more in annual income—fell to a rate of 2.35% in 2019, from 16% a decade earlier, Government Accountability Office data show.

“The audit numbers have gone down drastically over the past 10 to 15 years, and that’s something they’re looking to increase,” says Michael Gershon, a partner at accounting firm Janover. “That’s concerning to clients who are following the law.”

Gershon estimates the audit rate will pick up again in 2026 or 2027 once the IRS has trained new teams of agents. To prepare, he says, taxpayers should assume the IRS is always watching, even if the audit risk is low.

“Enforcement is always seen as ‘the taxman is coming for you,’ but it doesn’t necessarily need to have a negative connotation,” says JK Aier, a senior associate dean at the George Mason University School of Business. “Enforcement is essentially making sure that whatever Congress has in terms of tax policy is being implemented with integrity and with some level of fairness across all taxpayers.”

© 2025 Bloomberg L.P.