Matt Lundy

Nov. 30, 2020

In a typical recession, there is a tried-and-true playbook.

Incomes go down. Bankruptcies go up. Consumers pull back on major purchases. The services sector holds up better than goods. And the fiscal response takes months to materialize.

Not this time. In a most unusual year, the COVID-19 pandemic has flipped the recessionary script. That’s largely because of the swift reaction by central banks and governments to stabilize credit markets and deliver trillions in financial support to struggling families and businesses.

Given the situation, the past eight months have been a minefield for those in the business of forecasting. Many assumptions proved overly pessimistic, as forecasters often underestimated the resilience of consumers and the economy.

To be sure, not every prediction was a bust. Economists projected Canada’s GDP plunge in March and April would be record-setting – and it was. The restaurant and tourism industries are mired in deep funks that lobby groups warned about. As expected, oil demand has weakened as car and airplane trips were shelved. Economists also rightly said that Canada required unprecedented levels of fiscal support to avoid catastrophe.

Still, few were able to anticipate the overall strength in key areas of the economy, such as housing and spending on goods, even as many lower-income workers lost their jobs.

Here are five predictions that proved off the mark in the early days of the pandemic.

Home buying

Prediction: Sales and prices will drop

Reality: Real estate is stronger than ever

Back in May, Canada Mortgage and Housing Corp. published a bleak outlook for real estate. The national housing agency said the average home price would drop by up to 18 per cent from prepandemic levels, then start to recover next year. “Large declines in employment and household disposable income will cause large reductions in demand for existing homes in 2020,” CMHC said, predicting that home sales would plummet up to 29 per cent.

But things played out very differently. After a brief pause in the spring, home-buying activity has come roaring back. Through October, home sales have jumped nearly 9 per cent from last year, and the average price has climbed more than 12 per cent. There’s been strength in big cities (Montreal), small cities (Saint John) and even smaller ones (Woodstock, Ont.).

Why? For one, household disposable income rose a record 10.8 per cent in the second quarter, thanks to federal support programs. There’s also been a full labour recovery in higher income brackets, with the brunt of damage to low-paid workers who are more likely to rent. Interest rates have dropped and may remain low for years. And with heavy restrictions in place and millions working remotely, many families were suddenly untethered to their cities and could look further afield for larger homes.

The loonie

Prediction: A significantly weaker Canadian dollar

Reality: A brief hit, then a full recovery

Generally speaking, economic downturns and the Canadian dollar don’t mix well. During tough times, money flocks to safer locales and their currencies – notably, the U.S. dollar. That’s exactly what happened during the early stages of the pandemic, with the Canadian dollar tumbling below 70 U.S. cents in March. A Deutsche Bank analyst saw more trouble on the horizon: By year’s end, the Canadian dollar would be worth 66.7 U.S. cents.

But, “the Canadian dollar looked very cheap” around March, said Shaun Osborne, chief FX strategist at Bank of Nova Scotia. After that point, the loonie benefited from a recovering economy, stronger commodity prices and the U.S. dollar losing steam. Today, the Canadian dollar is trading around 77 U.S. cents – or right where many experts, before the pandemic, thought it would end 2020. “Most people would have been much better off leaving their forecasts exactly where they were,” Mr. Osborne said.

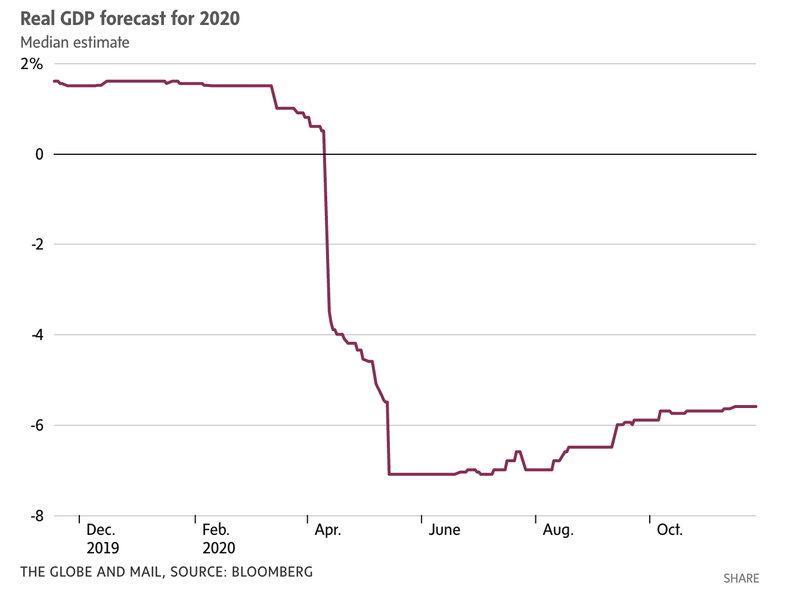

Gross domestic product

Prediction: GDP will plunge

Reality: GDP did plunge – but is recovering quickly

As the pandemic escalated in Canada, economists were continually ripping up their forecasts to downgrade the 2020 outlook. By May, the median estimate from the private sector was for real GDP to drop 7.1 per cent this year. But as the recovery unfolded, a number of key indicators – including employment, manufacturing sales and retail spending – were frequently performing better than expected. Today, the median estimate is for real GDP to drop 5.6 per cent in 2020, leaving Canada with a sizeable, but more manageable, hole to dig out of.

“Everyone was too pessimistic,” said Royce Mendes, senior economist at CIBC Capital Markets. “I think that’s understandable, given we were in the midst of a situation that we had never seen before in our lifetimes. … We went from operating as normal to being locked in our houses.”

After making its own big upgrade in October, the Bank of Canada pointed to three areas of resilience: a rebound in foreign demand for Canadian products, along with strength in home sales and goods consumption, aided by policy support.

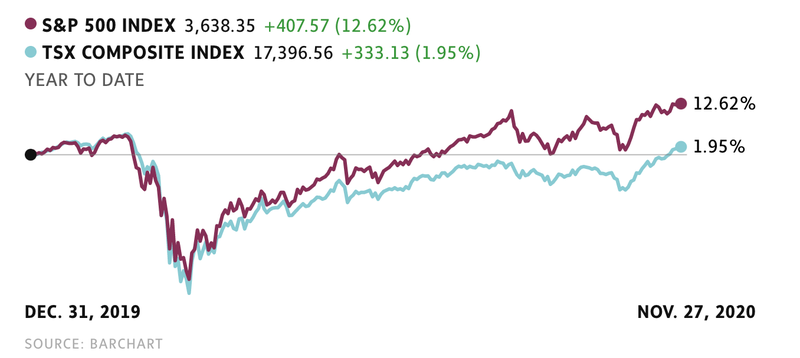

Stocks

Prediction: Equity markets will take years to recover

Reality: Markets took months to recover

As the gravity of COVID-19 became apparent, markets were rocked. The S&P 500 dropped 34 per cent over 23 trading days ending in late March, while Canada’s benchmark S&P/TSX Composite index plunged 37 per cent from peak to trough. In a short spell, virus fears wiped out trillions in wealth – and raised fears of past sell-offs that took years from which to recover.

As of mid-May, the S&P 500 was projected to drop 9.2 per cent in 2020, based on the average estimate from Wall Street strategists. That would be the worst annual performance for U.S. stocks since 2008.

Remarkably, markets began to shrug off the losses. By the summer, the S&P was in positive territory for the year and is now up more than 12 per cent. The S&P/TSX has also turned positive. Of late, stocks have been buoyed by positive news in vaccine developments.

“Stocks are forward looking and price conditions [six-plus] months ahead,” said Derek Holt, head of capital market economics at Scotiabank, in a recent client note. “By the time the worst news is hitting Main Street, stocks are already looking to the recovery.”

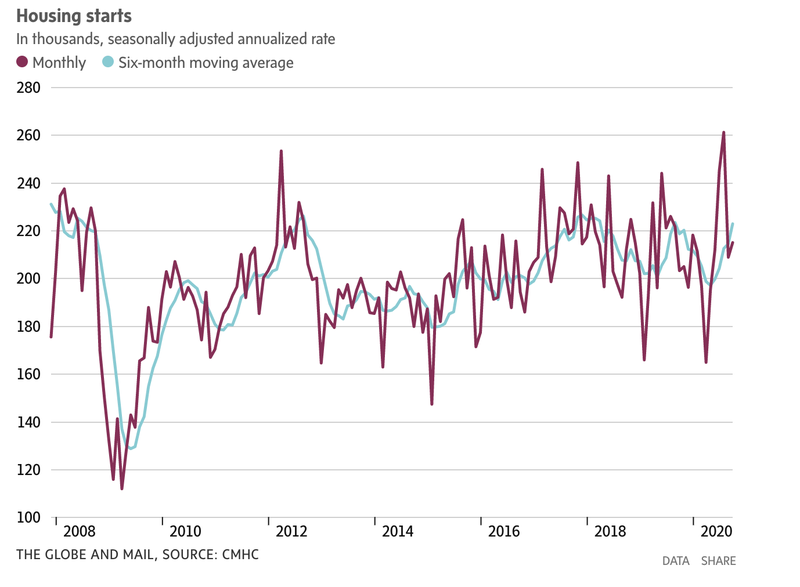

Home construction

Prediction: Housing starts will plummet

Reality: Housing starts are thriving

In its May outlook, CMHC said housing starts would fall sharply – between 51 per cent and 75 per cent in the second half of 2020 – relative to levels before the pandemic. Starts would begin to recover in 2021, but only modestly.

Instead, home-building has flourished, notwithstanding a hiccup in the spring. In October, housing starts improved to an annualized pace of around 215,000 units. “It does seem to be a bright spot in the overall economy,” said Kevin Lee, CEO of the Canadian Home Builders Association. Residential construction was largely unaffected by lockdowns, he added, while strong demand is helping push up prices for new builds. “The biggest [trend] we’re seeing right now is a renewed and increased interest in single-family homes.”

This Globe and Mail article was legally licensed by AdvisorStream.

© Copyright 2024 The Globe and Mail Inc. All rights reserved.