By Glenn Ruffenach

June 7, 2022

Regarding “rules” for budgeting in retirement, I set aside $100,000 in what I call my “Stuff Happens” account. It’s designed to get me through five years of unexpected and one-time expenses. My buddies have adopted the same approach.

Clearly your friends know a good idea when they hear one.

Those comments, from Roger Bretting, a retiree in Houston, were among many we received in response to my recent column about what I call my “$400 rule,” a household budgeting approach that I have adopted in retirement.

ILLUSTRATION: PAUL BLOW

The rule says that on average a retired couple will spend $400 a month more than they expect. This has proved correct in my case. In my column, I invited readers—retired or about to be—to share with me any rules, recommendations or strategies they have developed or embraced to fine-tune their own spending and saving habits.

My thanks to all who took the time to write. What follows are some of the most helpful ideas we received—starting with a warning.

Plan to be surprised

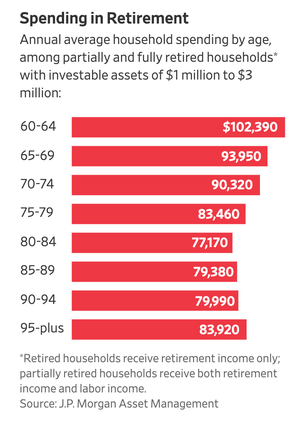

Interestingly, almost every reader asked me to warn people approaching retirement: Your spending in retirement likely will equal, or exceed, what you’re spending while working. Put another way: Take the conventional wisdom about needing 70% to 80% of your preretirement income to maintain your standard of living in later life and junk it.

“My wife and I spend 50% more in retirement than we did when working,” says Bob Bailey, 77, a retired advertising executive in Evanston, Ill. “There are two causes. First, we have time for travel, especially international travel. Second, we have volunteered in our community and discovered many needs; as such, our charitable giving has substantially expanded.”

Adds Kevin Baughman, 68, a retired pharmaceutical executive in Santa Rosa, Calif.: “I couldn’t see how I could spend less in retirement, given that I’d have more free time. So I targeted 90%. As I got closer to retiring, I moved it to 100%. My reality turned out to be closer to 110%.”

The single exception to this thinking among the comments we received: a couple who retired to a small town in Alabama. Their strategy:

“We expected the cost of living here to be lower than that in a third-tier city. However, we didn’t expect it to be substantially lower. We live better than we did in the city, in a nicer home, engage in far more activities, and spend less. We would advise anyone planning retirement to consider moving to a small town for both quality of life and financial reasons.”

Keep budgeting

If you develop a household budget for retirement—great. But a number of readers told us: This isn’t, or shouldn’t be, a one-time exercise. It’s critical, they said, to refine your budget annually.

“My wife and I consciously research ways to ‘cost reduce’ each year,” writes H.L. Singer, 76, a retired chief executive officer in Melbourne, Fla. Among their steps, small and large: reviewing and, as necessary, changing (or simply canceling) streaming services and magazine/newspaper subscriptions; booking travel a year in advance; fixing more meals at home; making better use of programmable thermostats; researching purchases and then waiting for sales and coupons.

Mr. Singer says: “We have found that by constantly looking for ways to lower expenses and buying smart we can do a better job of making our retirement savings and pension go further.”

Leave wiggle room in the budget

In my earlier column, I set out my personal retirement rule: Calculate a household budget for the year—and then add $5,000 (roughly, $400 a month) for out-of-the-blue bills. That total will be closer to the income you’ll actually need. Several readers told me my math wouldn’t work for all parts of the country (read: high-cost areas) and offered a better solution: simply add 10% to whatever budget you first produce.

“It seems almost every month there is an ‘extraordinary’ expense that blows the budget,” writes Michael Arvanetakis, 69, in Cypress, Texas. “My wife and I have encountered this our whole lives. Our rule is add 10% to your budget—always.”

Ronald Londe, 76, a retired energy-stock analyst in St. Louis, made a similar point. His rule: “During December each year, I work up an estimated family budget for the coming year. On the total expected spending, I add 5% for inflation and 10% for unknown events. I then adjust my income ‘bucket’—primarily quality dividend stocks—to generate the required annual cash.”

Start a rainy-day account

Another way to handle the unexpected: rainy-day money. Mr. Bretting, at the top of this column, is one of several retirees who say they squirreled away a chunk of money expressly to cover unanticipated bills early in retirement, when nest eggs are at their most vulnerable. His “Stuff Happens” account, he writes, has been a “mental lifesaver.”

“In the 2½ years that I have been retired, I have paid $8,500 for frozen-pipe damage; $3,500 for my spouse’s dental issues (no dental insurance); $25,000 for my youngest needing an extra semester of college to graduate; $1,500 for two accidental drownings of cellphones; and $5,000 in flood damage to our sprinkler system and landscape.”

He concludes: “I do sleep better at night knowing there’s still some money available for the next ‘Stuff Happens’ event.”

Fluffy and Fido? Maybe not

Finally, Bruce Woods, a retiree in Seneca, S.C., has more than a dozen financial strategies for retirement, but one rule jumps out:

“If you have pets, don’t replace them,” he says. “My wife and I travel a lot more in retirement, and the bills for kennel care were over $1,000 a year. Get out the pictures of them and enjoy hair-free furniture. You won’t miss the constant picking up and cleaning up after them.”

Copyright 2022 Dow Jones & Company, Inc. All Rights Reserved.