By Oyin Adedoyin

Oct. 17, 2023

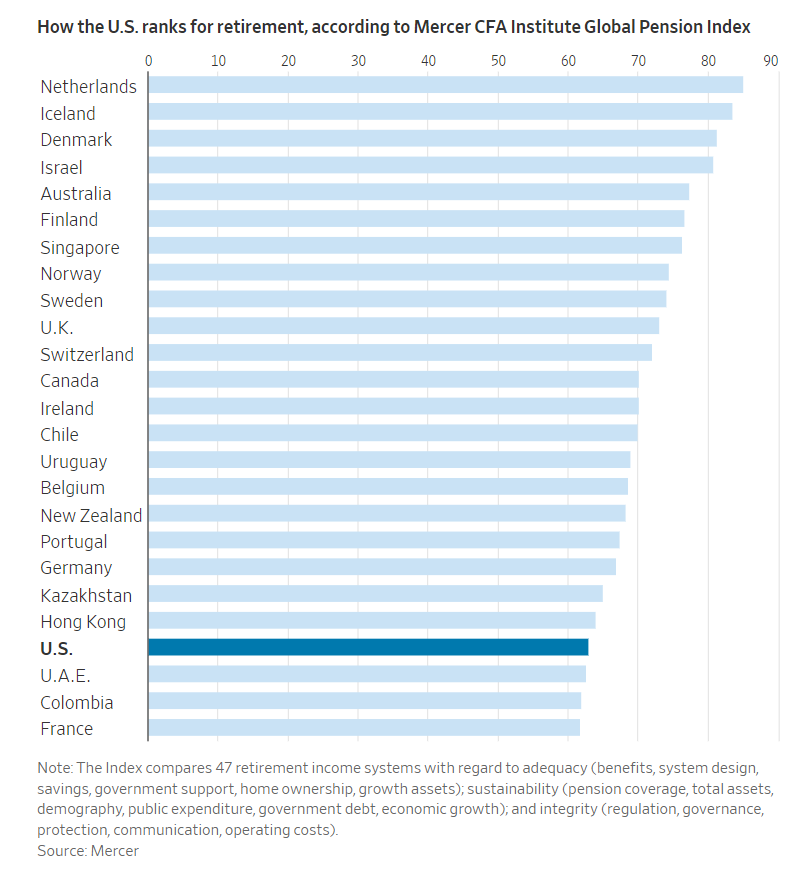

In a new ranking of the world’s retirement systems, the U.S. scored a C+, falling further behind the Netherlands, Australia and Sweden.

iStock image

The U.S. came in 22nd out of 47 countries, according to the latest Mercer CFA Institute Global Pension Index, released Tuesday, with a slightly lower score than a year ago. The way Americans fund their retirement is primarily through Social Security and savings in 401(k)s and individual retirement accounts. That setup has some major shortcomings, particularly when it comes to long-term solvency, the report said.

“In the U.S., there’s good coverage of white-collar workers through employer systems. But what about the gig workers? What about the blue-collar workers?” said David Knox, a senior partner at Mercer and lead author of the report.

In many countries, including the U.S., an ever greater share of the responsibility for retirement security now rests on individuals, said Margaret Franklin, president and chief executive of the CFA Institute.

The index factors in both government and private-sector sources of retirement income, and also considers the impact of homeownership and household debt on retirement finances. The index ranks the best retirement systems, not necessarily the best places to live in retirement.

Employers in the U.S. aren’t required to provide retirement plans to all workers. Automatic enrollment in 401(k) plans has helped improve participation and boosted total retirement savings. But many Americans don’t have access to a 401(k) or choose not to put money into individual retirement accounts on their own.

American retirement savers also can withdraw savings early, shortchanging their future security.

The Netherlands, where all workers have both a private and public pension account, ranked at the top of the list. Its system has three components. There is a public pension that provides a flat rate to all retirees depending on how long they have lived and worked in the country. Then there is a semi-mandatory requirement for employers to provide all workers with a pension. Additionally, individuals can contribute to their eventual retirement income with their own investments.

Many American retirees are stretched thin and rely on family for financial support, said Katie Hockenmaier, U.S. defined-contribution research director at Mercer’s wealth practice. In the past few years, high inflation further strained the finances of retirees, reducing the spending power of those living on a fixed income.

Though the U.S. received average marks in the report, some countries are far worse off. Argentina ranked last out of the 47 countries in the index, due to its limited public pension system and voluntary employer-based plans.

Write to Oyin Adedoyin at oyin.adedoyin@wsj.com

Dow Jones & Company, Inc.