By Claire Ballentine and Paulina Cachero

May 24, 2022

Entering adulthood is hard, and inflation is making it even more difficult.

The biggest jump in prices in four decades is greeting Gen Z just as they’re graduating from college, moving out on their own and starting their first jobs. Add in real estate prices that have put home ownership out of reach, plus stocks suddenly cratering after two years of gains, and it’s a brutal welcome to the real world.

iStock-1159099081.jpg

“Inflation is challenging for younger generations because they have to bear all the costs of inflation, but don't necessarily own the assets that will help their balance sheet keep pace with inflation,” said Jeff McDermott, certified financial planner at Create Wealth Financial Planning.

For those who haven’t experienced market cycles in the past, this sudden change in the stock market and the economy is especially confusing. To help demystify the world of rate hikes and economic gauges, here are a few common questions answered:

What is inflation?

Technically defined as a decline in a currency’s purchasing power, inflation manifests as an increase in the price of goods and services. It’s not always terrible and can even promote growth, as long as it’s maintained at a relatively low level. In fact, the Federal Reserve aims to keep inflation at a rate of about 2%.

However, the most common measure of inflation in the US — the consumer price index — surged 8.3% in April from a year prior, among the highest readings since the early 1980s. That means it now takes consumers more money to buy the same amount of goods, plus their cash savings are worth less than they were a year ago.

It’s complicated. The pandemic caused factories and plants to shut down or produce fewer goods, and disruptions to the supply chain made it more difficult to get those goods to consumers. Meanwhile, Covid stimulus checks and increased savings from months of lockdowns made consumers more willing to spend, particularly as the pandemic eases in many places. That combination, of lower supply and higher demand, is pushing up prices.

The war in Ukraine and resulting sanctions on Russia made the situation even worse by sending prices surging for oil and key food exports like wheat and corn, which is making it more expensive for regular people to fill up their cars, heat their homes and buy groceries.

How do we fix inflation?

Enter the Federal Reserve. One of its main jobs is to keep prices stable, which it can do by raising or lowering interest rates. Most recently, the Fed increased the benchmark rate by a half percentage point, the biggest hike since 2000. Although inflation declined slightly in April from the prior month, it’s still extremely elevated and the Fed will almost certainly raise interest rates several more times this year. This is prompting fears of an economic slowdown, which is sometimes an unintended consequence of higher rates.

Why is Gen Z suffering the most from rising prices?

Younger people usually have less savings and make a lower salary than their older peers, making it even more difficult for them when everyday necessities like gas and groceries suddenly cost more. Plus, many are struggling under debt from college, with 34% of adults aged 18 to 29 holding student loans, according to the Education Data Initiative. And wages haven’t kept up with inflation, rising just 4.7% in the first quarter from a year earlier.

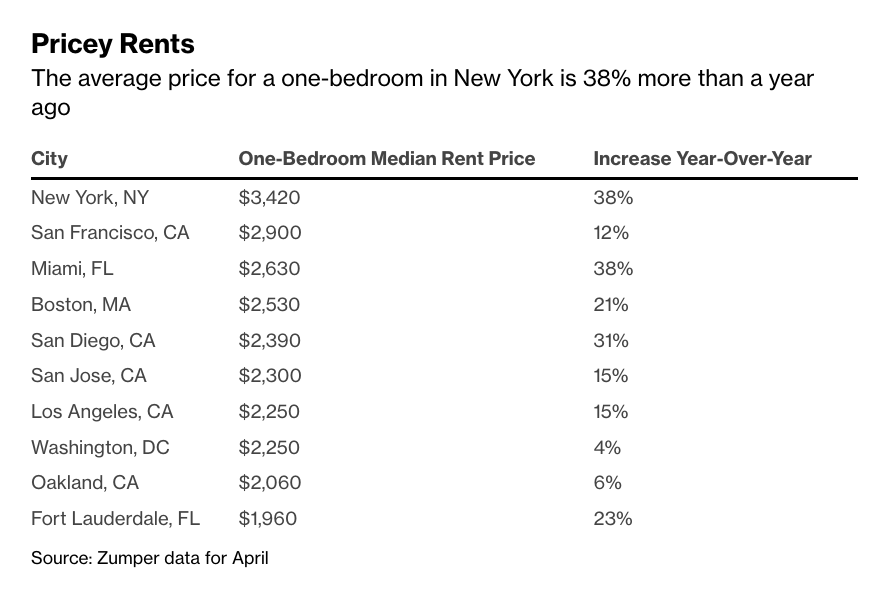

Gen Zers are also finding that a larger portion of their hard-earned paychecks is going toward housing costs. Rents have surged almost twice as fast so far in 2022 than the year prior, particularly in major metropolitan areas like New York City, where they jumped by 38% in April to a median monthly cost of $3,420 for a one-bedroom apartment, according to Zumper.

The recent stock market downturn is only making matters worse. Longer term, financial advisors say investing in stocks, especially through tax-efficient strategies like 401(k)s, is a smart move. But it’s hard to watch hard-earned investments shrink, even more so if they’re earmarked for a down payment on a house or a wedding.

And timing is everything: for those who put money in the S&P 500 Index at its pandemic depths in March 2020, they’ve made a total return on their investment of about 80%. But those who invested at the beginning of this year are facing a decline of nearly 20%.

It’s a similar story in the housing market. Those who owned homes before the pandemic have ridden a nationwide boom in house prices, building equity along the way. But that same trend has left homeownership out of reach for many younger people. In February, a gauge of home prices in the 20 largest US cities rose 20.2% from a year prior. At the same time, mortgage rates are now at the highest since 2009, pushing up monthly payments.

What can you do to protect your wallet?

The main thing advisors stress: don’t panic. Although this year’s drop in stocks has been startling and rising prices are straining budgets across the country, the pain is likely temporary.

Historically at least, equities rise over time. That means it’s actually a good idea to invest in broad-based indices like the S&P 500 now, when stocks are cheaper, said Jonathan Huss, certified financial planner at Hussmen Financial. He also recommends re-examining your budget and cutting back on items like subscription services.

Another tactic is to embrace sharing, according to Eric Walters, founder of Summit Hill Wealth Management.

“It’s a good time to get a roommate and share the cost of a hotel room with friends for travel,” he said.

Finally, it can be helpful to know which items are most affected by inflation. For instance, prices for gas and airplane tickets are soaring, while the cost of admission to sports events and movie tickets aren’t.

“Make sure to budget your fun spending, and don't get caught spending too much for things that don't really bring you any joy and aren't necessities,” said Joseph Brady, founder of Rock Financial Planning.

© 2025 Bloomberg L.P.